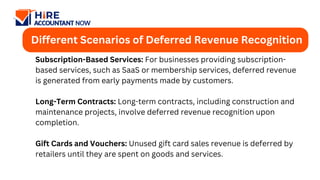

Doing so will help you higher perceive whenever you earn your income and the value of that income. The most recent previous accounting standard for subscription income is ASC 605. When you evaluate ASC 606 vs ASC 605, there’s one significant difference — that distinction is how gross sales commissions are reported. Based on these examples, you can see the cash technique is rather more straightforward –– on paper –– than the accrual method. However, investors and creditors depend on accrual monetary statements when evaluating a enterprise.

This strategy supplies a extra correct picture of an organization https://www.intuit-payroll.org/‘s monetary efficiency and helps stakeholders better understand the true worth of subscription contracts over time. The final step is recognizing income as you fulfill the efficiency obligations. For subscription companies, this sometimes means recognizing revenue over time as companies are delivered. The precept of revenue recognition states that revenue should be recorded when it is earned and realizable, not necessarily when money is acquired. For subscription models, this typically means recognizing income over time as companies are provided or as prospects gain access to merchandise.

Finest Practices For Managing Deferred Revenue

In The Meantime, a income manager would possibly spotlight the benefits of detailed analytics and reporting options that help in income forecasting and evaluation. As experts like Binary Stream observe, ignoring these guidelines can mislead buyers and set off compliance risks. Ensure that your accounting and finance teams are well-versed in subscription-specific accounting ideas. Regular training may help your team stay up to date on regulatory modifications and greatest practices in subscription accounting. When you outsource your bookkeeping you not solely save time, however get correct monetary insights so you can make knowledgeable selections for your corporation. Subscription fashions usually involve advanced billing, numerous contract phrases, and changing buyer wants.

Handling deferred revenue precisely to replicate companies not but delivered and managing multi-currency transactions for worldwide businesses also add layers of complexity. Operating a subscription enterprise means dealing with the complexities of subscription income accounting. It Is not all the time easy, but correct income recognition under ASC 606 is crucial.

- Differentiating between these parts presents a granular view of financial stability.

- The enterprise would require the customers to pay upfront before consuming the service.

- For the previous 52 years, Harold Averkamp (CPA, MBA) has labored as an accounting supervisor, supervisor, consultant, university teacher, and innovator in teaching accounting on-line.

- Get $30 off your tax submitting job right now and entry an reasonably priced, licensed Tax Skilled.

Monthly Recurring Income (mrr) Explained

They leverage our ASC 606 software to course of massive amounts of income data and contract modifications, close books quicker, and gain correct income insights. This part explains the journal entries you make at completely different levels of the income recognition process. When looking for loans or attracting buyers, correct income reporting is paramount. Lenders and buyers depend on financial statements to assess an organization’s monetary health and growth potential. Clean, accurate revenue figures construct trust and show monetary stability, making a company extra engaging. Inconsistencies or inaccuracies in revenue recognition can increase purple flags, probably jeopardizing funding.

For a useful breakdown of performance obligations and transaction price allocation, try this guide. Remember, the impression of ASC 606 could be more about enhanced disclosures than bottom-line changes, so specializing in clear documentation is essential. You want methods that may track contracts, performance obligations, and revenue allotted to each.

This ensures that income for every component of the bundle is acknowledged because the associated service is delivered. Precisely separating the value of each element throughout the bundle is essential for GAAP compliance. For advanced bundling eventualities and high-volume transactions, consider automating your revenue recognition with a solution like HubiFi to ensure accuracy and effectivity. Grasp subscription revenue accounting with this important information on GAAP rules, ensuring accurate monetary reporting and compliance for your small business. HubiFi offers Automated Income Recognition solutions that simplify the process from start to end.

These two ideas are often confused, but they symbolize reverse sides of the revenue recognition coin. ASC 606, also referred to as the Revenue from Contracts with Clients normal, is a comprehensive revenue recognition guideline issued by the Financial Accounting Requirements Board (FASB). Hubifi.com underscores that specialized income recognition software program not solely streamlines processes but in addition enforces compliance with ASC 606 guidelines.

Schedule a demo with HubiFi to see how our options may help you achieve correct, compliant, and automatic income recognition. Imagine you sell a software subscription for $1,200 yearly, billed upfront. Instead of recognizing the complete $1,200 as revenue at the time of buy, you recognize it month-to-month because the service is supplied. ASC 606 and its international counterpart, IFRS 15, mark a big change in how firms acknowledge income.

Proper record-keeping and deploying a income recognition software program resolution can handle this problem. Keep learning, keep curious, and don’t hesitate to seek expert steerage when navigating the intricacies of subscription revenue accounting. Your financial readability today will pave the way for your small business’s success tomorrow. This example demonstrates how income recognition for SaaS firms works in practice. By recording $100 of revenue every month, you’re aligning your accounting with the actual supply of companies, a key precept of ASC 606 compliance.

According to statistics, the digital financial system in the US is valued at over four.27 trillion dollars. Income recognition for subscription companies should adjust to either the Usually Accepted Accounting Rules (GAAP) or the Worldwide Financial Reporting Requirements (IFRS). GAAP is primarily used within the Usa and is overseen by the Monetary Accounting Requirements Board (FASB).